What does YTM mean? What is the full form of YTM?

The full form of YTM is Yield to Maturity

Yield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

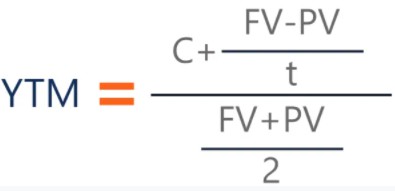

YTM is typically expressed as an annual percentage rate (APR). It is determined through the use of the following formula:

Where:

- C – Interest/coupon payment

- FV – Face value of the security

- PV – Present value/price of the security

- t – How many years it takes the security to reach maturity

The formula’s purpose is to determine the yield of a bond (or other fixed-asset security) according to its most recent market price. The YTM calculation is structured to show – based on compounding – the effective yield a security should have once it reaches maturity. It is different from simple yield, which determines the yield a security should have upon maturity, but is based on dividends and not compounded interest.

YTM

means

Yield to Maturity![]()

Translate Yield to Maturity to other language.

Leave a Reply

You must be logged in to post a comment.