What does MOIC mean? What is the full form of MOIC?

The Full Form of MOIC is Multiple on invested capital.

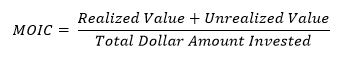

Multiple on Invested Capital (or “MOIC”) allows investors to measure how much value an investment has generated. MOIC is a gross metric, meaning that it is calculated before fees and carry. It can be calculated at the deal level or the portfolio level to evaluate the performance of both realized and unrealized investments. This metric is highly valuable for both deal level and portfolio analysis and reporting. MOIC is calculated by:

MOIC-Formula

MOIC is important for performance reporting because of its simplicity. It is easy to understand that a multiple of 1.50x means that the principal investment amount has increased in value by 50%. This metric, which is directly tied to the dollar amount invested, is often a more digestible performance indicator than IRR. This is because MOIC simply accounts for the change in gross value and does not attempt to account for the amount of time required to do so.

MOIC

means

Multiple on invested capital![]()

Translate Multiple on invested capital to other language.

Leave a Reply

You must be logged in to post a comment.